Port congestion in Singapore and global shipping situation analysis

Recently, the issue of congestion at Singapore's ports has become a focus of attention in the industry. To address this situation, authorities have reopened closed terminals, raising the port's weekly handling capacity from 770,000 standard boxes to 820,000 standard boxes, thereby improving the port's weekly handling capacity.

However, the problem remains severe. Box volumes at the port increased by 4% year-on-year in the first four months of 2024, but this was mainly due to carriers trying to catch up with Singapore's schedule. This was due to a sharp increase in container volumes due to supply chain disruptions, as well as ships "congregating" and waiting times being extended. At the same time, due to several shipping companies unloading more containers and abandoning subsequent voyages to catch up with time, the number of containers handled per ship has also increased.

Currently, there are many container ships waiting for berths or conducting cargo operations in Singapore. Meanwhile, global vessel schedule reliability is also declining, and the dynamic of port congestion and deterioration of liner schedules seems to be spreading rapidly. Carriers and freight forwarders are facing challenges in recovering their transportation costs.

Here is an example from NVOCC CargoGulf, headquartered in Dubai, which only updated the daily schedule for one of its AGA services:

"The vessel is currently operating ETD JEA on May 30th (port stay approximately 89 hours). The vessel is severely delayed due to NGB port closure/SHA/SHK congestion." Due to congestion (and monsoon/heavy rains), CMB simulated 48-hour berth delays. Due to 5-7 days of congestion, the SIN e/b service will be omitted. As shown in the case of NVOCC CargoGulf in Dubai, due to port closures, congestion, and other reasons, ships were seriously delayed, and the company had to impose a port congestion surcharge on its westbound service. Each port faced significant delays, causing ships to "congregate," which posed great difficulties for shippers and logistics enterprises.

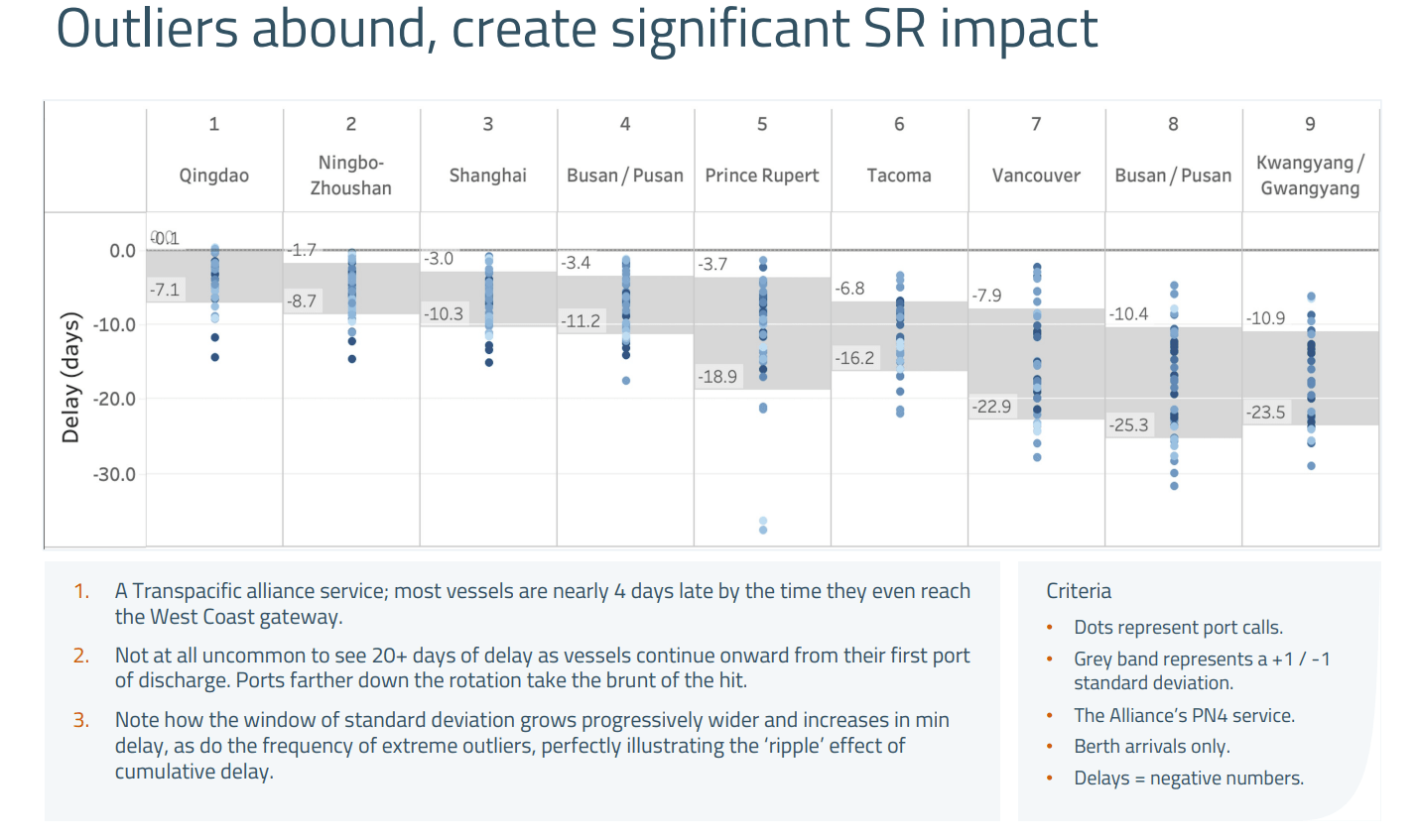

The Q1 Schedule Reliability Scorecard, also shows the ripple effect of congestion and delays in services, even after the initial service call, with Chinese ports congestion causing long delays for vessels on their return trips. This further underscores the widespread impact of port congestion on global shipping. Of course, reopening abandoned terminals is only a temporary solution. To address the port congestion problem from the root cause in a long-term manner, a series of efforts are needed. For example, continuous improvement of port infrastructure, further enhancement of supply chain efficiency, and strengthening cooperation with other ports. At the same time, close monitoring and timely warning of port congestion is also crucial, so that prompt responses can be made when problems arise.

In summary, the port congestion problem in Singapore is just a microcosm of the global shipping predicament. In this situation, all parties need to actively respond and find effective solutions to ensure the smooth operation of global trade.